Financial Insights

News and resources for your financial life.

New Tip and Overtime Deduction Provisions Under H.R.1

H.R.1 introduces two below-the-line tax deductions for qualified tips and for qualified overtime compensation.

While the new law does not eliminate payroll taxes on this income, there are income tax deductions available to taxpayers below certain income limitations. The new Act allows taxpayers to deduct up to $25,000 in qualified tips and $12,500 in qualified overtime on their personal tax return. These deductions will be effective for tax years 2025 through 2028.

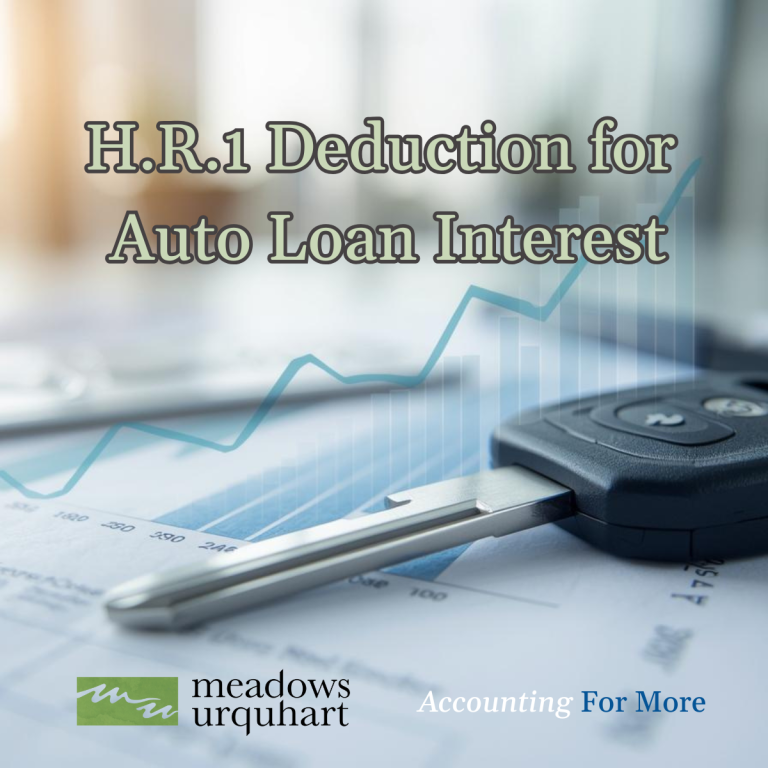

H.R.1s Deduction for Auto Loan Interest

Effective for 2025 through 2028, a taxpayer may deduct up to $10,000 of “qualified interest” paid on a loan used to purchase a “qualified new vehicle.” This deduction is available for taxpayers who itemize or take a standard deduction. Full deduction is available for taxpayers with modified adjusted gross income (AGI) under $100,000 or $200,000 for joint filers. The deduction completely phases out for taxpayers with modified AGI over $149,000 or $249,000 for joint filers.

My Journey from Intern to Staff Accountant at Meadows Urquhart

The transition from intern to staff accountant was smooth, thanks to the supportive onboarding staff and reviewers. I was welcomed back into the same close-knit, family-like environment that made my internship experience so rewarding.

H.R.1 – Two Changes for Charitable Contributions Starting in 2026

Currently taxpayers need to itemize their deductions to benefit from charitable donations. For a brief period during COVID-19, a temporary charitable deduction was allowed for non-itemizers. Section 70424 of H.R.1 restores this deduction permanently and increases the deduction amounts.

Did you claim the Employee Retention Credit (ERC)?

If your ERC payment arrived in 2024 or 2025, you're not alone in wondering what to do. The good news is with the updated March 20th 2025 guidance from the IRS - you won’t need to file an amended return or an administrative adjustment request (AAR) for the year you originally claimed the ERC.

Meadows Urquhart Recent Promotions

We are excited to recognize the achievements of several team members with well-deserved promotions. Their dedication and contributions continue to strengthen our firm and the service we provide to our clients.

Is it time to consider a Roth conversion?

Is it time to consider a Roth conversion?

Are tax rates going up in 2026? That’s a great question. As the AICPA put it in February 13th’s Town Hall session, there’s a “long winding road” ahead of us as budgets, reconciliations, and tax packages battle their way through Congress.